Net present value of annuity

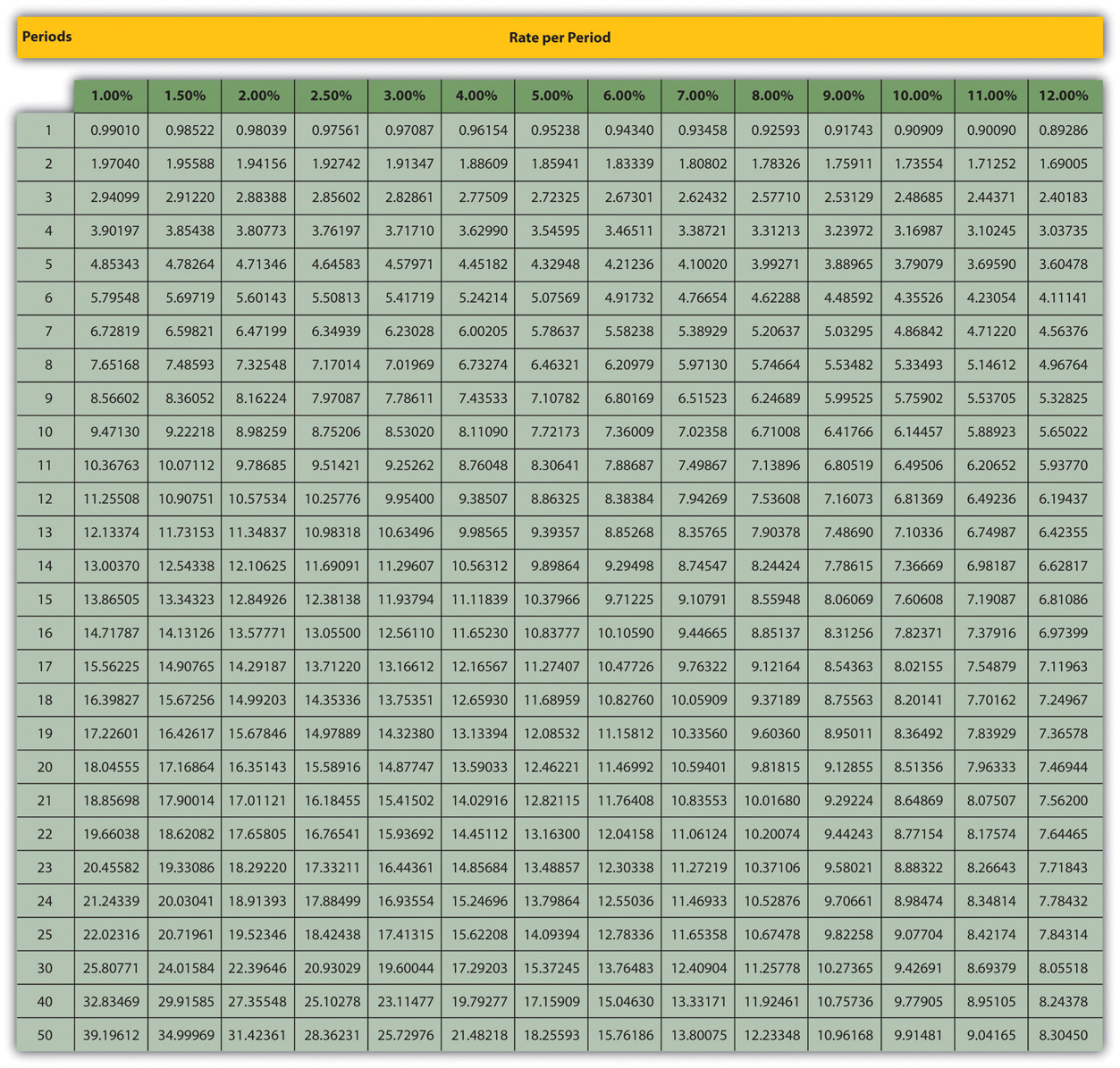

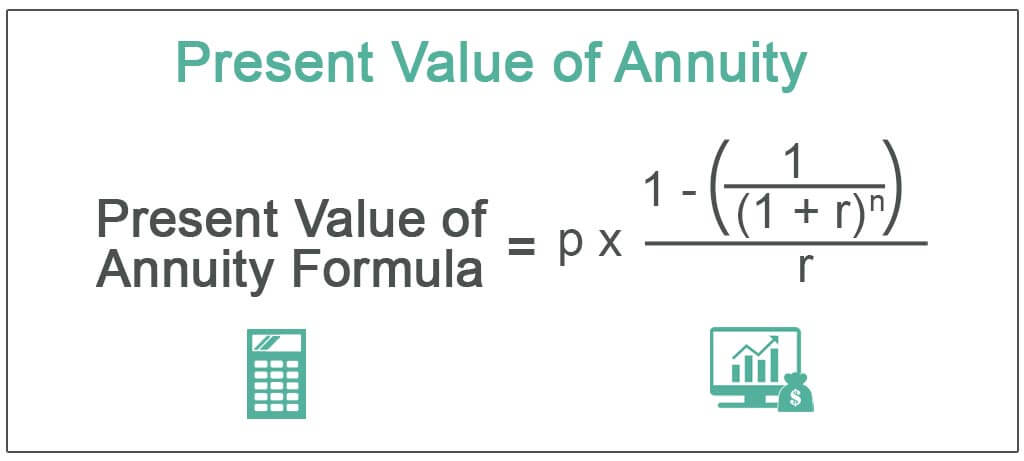

The present value of annuity formula determines the value of a series of future periodic payments at a given time. By having a table that consists of the various factors associated with given rates and periods.

What Is An Annuity Table And How Do You Use One

To help you better understand how to calculate future values an online calculator for investors.

. Net Present Value NPV. What Is Customer Lifetime Value. The present value of annuity formula calculates the value of a series of payments at a given time.

In year 2021 the annuity will have a Future Value of 5694896. The Present Value of Annuity Formula. A cash flow is an amount of money that is either paid out or received differentiated by a negative or positive sign at the end of a period.

The present value of annuity formula relies on the concept. It relies on the concept of the time value of money ie one dollar today is worth. The payment variable can be taken out of the formula to determine the factor.

You can use a formula and either a. From example 1 let. Using this value formula the calculation is 1200 FV 1.

By using the geometric series formula the present value of a growing annuity will be shown as. Calculating the present value of annuity lets you determine which is more valuable to you. This formula can be simplified by multiplying it by 1r 1r which is to multiply it by 1.

This can be shown by looking again at the extended version of the present value of an annuity due formula of. Net present value of a stream of cash flows. The present value of annuity formula determines the value of a series of future periodic payments at a given time.

Here is the present value of an annuity formula for annuities due. Present Value PMT x 1 - 1 r -n r x 1 r Where PMT is. Of course this value calculation includes the idea that you simply could earn 3 on the 1000 over the subsequent.

The future value of an annuity is a difficult equation to master if you are not an accountant. Find the present value PV of the annuity account necessary to fund the withdrawal given. There is a formula to determine the present.

Formula to Find the Present Value of an Annuity Due. Assume end-of-period withdrawals and compounding. Jun 02 2022 The present value of annuity changes as the interest rate environment in the economy changes.

This formula shows that if the present value of an annuity due is divided by. The present value of annuity formula relies on the concept of time. Daniel Alamillo Jr.

The table illustrates a hypothetical deferred annuity payments plan at an annual rate of 006 percent. Three approaches exist to calculate the present or future value of an annuity amount known as a time-value-of-money calculation.

Present Value Of A Growing Annuity Formula With Calculator

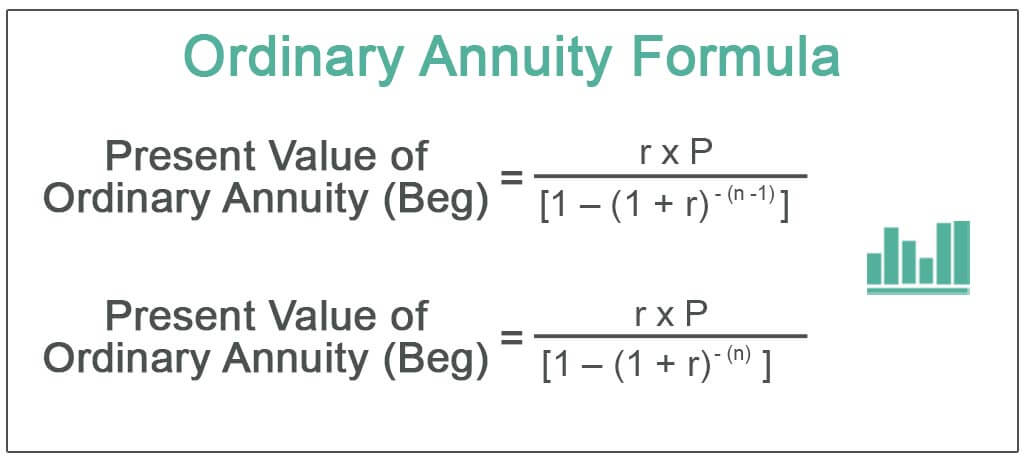

Ordinary Annuity Formula Step By Step Calculation

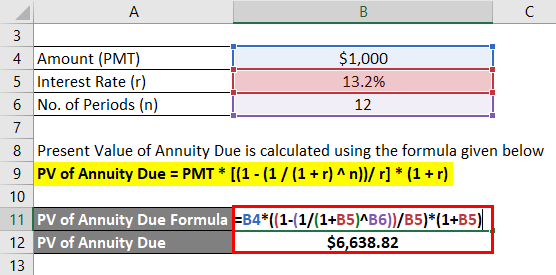

Present Value Of Annuity Due Formula Calculator With Excel Template

How To Calculate The Present Value Of An Annuity Youtube

Present Value Of Annuity Due Formula Calculator With Excel Template

Present Value Of An Annuity How To Calculate Examples

Appendix Present Value Tables Financial Accounting

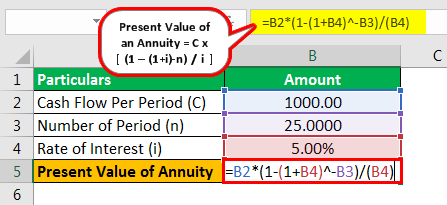

Excel Formula Present Value Of Annuity Exceljet

Present Value Of Annuity Formula With Calculator

Annuity Present Value Pv Formula And Excel Calculator

Present Value Of An Annuity How To Calculate Examples

Annuity Present Value Pv Formula And Excel Calculator

Annuity Formula Present Future Value Ordinary Due Annuities Efm

Present Value Of Annuity Formula Calculate Pv Of An Annuity

Present Value Of An Annuity Definition Interpretation

Present Value Of Annuity Formula Calculate Pv Of An Annuity

1 Present Value Annuity Formula Download Scientific Diagram